Forever Love: Leaving a legacy for your children with AIA Philam Life

One of the things that I have become increasingly aware of when I became a mother is my mortality and how it affects my children should anything happen to me. Growing up, the most I’ve been taught about preparing for my financial future was to save a portion of my money and put it in the bank. No one explained to me how it works except that it would be something I can withdraw in cases of emergency.

I guess, one of the things that contributed to my ignorance on these things was my youth. I lived quite rebelliously and recklessly, after all, I was young and only cared about myself and no one else. When you’re young, it’s easy to get lost in the moment and think it’s always going to be the same. And you tend to think there’s always tomorrow to worry about the rest of your life.

Motherhood and Mindset shifts

But motherhood changes you. I know it changed me. Life was no longer about me alone. The minute my eldest child was placed in my arms, I knew that I would do anything in my power to ensure that he will have all the opportunities he deserved, and more. And I feel just as strongly for my two other children.

But here’s the thing – my poor financial decisions in my past had boomeranged on my adult life. My husband and I struggled for years and it’s quite a fight we have to put up to be able to give our children the same opportunities other kids have.

Dealing with sudden death

Then, about 7 years ago, my brother unexpectedly died of a heart attack in the middle of the sea, while scuba diving in Batangas. He was only 47 years old. He left behind three children, one of whom was still a baby. I saw the quality of legacy he left to them when he passed.

It was a wake up call for me to get my act together.

So, if there’s anything I’ve learned from this journey, it’s these 3 things:

1. Manage our finances wisely.

Money comes and goes. I think the Pandemic has sealed this for us. A lot of people lost businesses and sources of income during this time. So it is best to wisely allocate our finances when they come so that we can be ready for the rainy days.

2. Sacrifice, if we must, to ensure the future of our children.

What would happen to our children if Jay or I will get into an accident and become disabled? Or if one or both of us suddenly die? It all sounds so morbid, I know, and it’s so hard to talk about it. But the truth is, not dealing with it doesn’t make the realities of this life go away. The only thing avoiding it will do to you is make you lose time and delay you from preparing for what may happen.

It will take some sacrifices on our part, but if we love our children, we will do whatever it takes to ensure their financial future before it’s too late for us to do so.

I think this video gives us a clearer picture of what it’s like to truly love our children:

3. Pass this wisdom on to our children while they are still young.

Our children earn their own money from professional projects, so we teach them how to save them and invest them. And this early on, we teach them about insurances and the benefits of investing in these insurances while they are young.

Like I said earlier, I didn’t know any better because no one taught me these things while I was growing up. To stop the cycle, I must pass on the things we’ve learned to our children. Teach them the value of investing in their future and the future of the people they love early in their lives.

AIA (All-in-One) Philam Life Insurance

AIA Philam Life Insurance is the perfect solution available for people who want to plan for their family’s future through legacy planning.

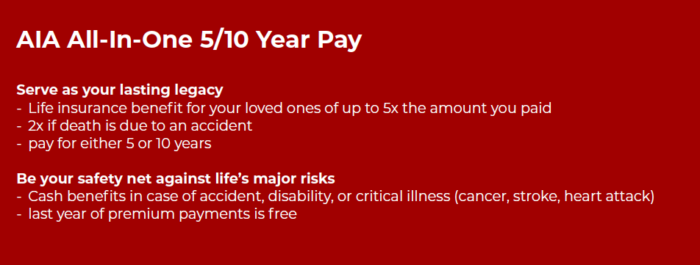

Untimely death, accidents, disability or critical illnesses — all of these are covered under AIA Philam Life which you can complete payment for in 5 to 10 years.

Here’s a quick glance at AIA coverage:

Let your love live on. Start planning for your family’s future as early as now! For more information about AIA All-in-One, here are the details you need:

AIA Philam Life

Official Website: https://www.philamlife.com/en/our-products/protection/aia-all-in-one.html

Facebook page: https://www.facebook.com/AIAPhilamLife

Email address: [email protected]

Contact number: (02) 8528-2000

22 Comments

Karla Nina Mallannao

For now, I have 1 insurance already. Thinking if I should get another one? Because some of my friends have 2-3 accounts. What do you think is the best?

May De Jesus-Palacpac

What type of insurance do you have? Personally, I think health insurance should be priority as health cards usually can’t cover all expenses of serious illnesses. Then of course, Life insurance for when you pass so you have something to leave your loved ones. Also house insurance and car insurances if you own them, are practical.

Pinaynursemeetsworld

I will be getting another insurance for myself and for my daughter. I am so glad that the hospital I am working in right now covers our medical, dental insurance. But, I will still get one for myself in preparation for the future.

Christianforemost.com

I don’t think that I’m smart with my money, but I’m learning. I also got insurance to prepare for the future. I still don’t know if I’ll have kids in the future, but it’s good to start investing whole I’m still young.

May De Jesus-Palacpac

You’re still young, so you have a lot of opportunities to work things out.

Janella Herrera

My mom taught me the importance of money and finances when I was young. Now that I am 21, I am slowly learning to manage me salary as a freelancer. Hoping once I graduate, I will be apply to apply what I learned in my independence.

Janessa Pablo

i saw the ad before and it honestly made me cry. getting my bf and i life insurances by next year

clang clang

Ilang mga friends and colleagues na ang nagdiscuss about ng Life Insuranc at until now di pa rin ako nakakakuha. Konting ayos na lang ng budget and hopefully nextyear makakuha na ako.

Ben

It’s so important to ensure that our family is taken care of if we should die suddenly. Life insurance is something that every parent should have. This sounds like a great policy.

Hazel

I have life insurance and medical insurance. I think insurance is really important as anything can happen, we cannot predict critical illness or something worst. I don’t have a family of my own pa, but when I do, I’ll make sure to start them early as well. 🙂

Ivan M. Jose

These are practical tips that I can teach my children. My wife and I are great believers in the advantages of being ensured.

yudithnapitupulu

I have life insurance and medical insurance. The insurance is really important. I got benefits using insurance. Everyone should thinking about this, buying insurance is important as it ensures that you are financially secure to face any type of problem in life.

Nicole P.

I don’t have insurance yet as I know that I can’t commit because I will have lapses for now… (hello housewife probs) But once things are relatively stable I am pretty sure that I am getting this too. I’ve seen unexpected things happen and I know that time is pretty short which is why I am excited to get my own hopefully next year 🙂

Dale

Been working for some time now and I still don’t have an insurance plan. Think I’ll look into this one.

WanderWoMom

naiisip ko din ito minsan. ang morbid man, pero reality check. kaya praying na magka extra na ako para magkaron na ako ng ganto. recently my brother had an operation, 1/4 lang ng bill ang shoulder ng parents. sobrang laki ng help niya.

Jowell Juanillo

Legacy planning, this is what all Filipinos should learn about, specially during this pandemic. There are so many learnings this pandemic has opened our eyes for.

Blair villanueva

I have a different views about insurance.

Like, I got an insurance for myself and not for my future children. The education that I will provide to them is the tool (or insurance) that I will provide to them, to help them prepare for their own future hence, they can’t expect anything from me. If I die, my insurance will cover the expense and not them worry, but still they wont get anything.

This is the why children must value education first.

Elizabeth O

This is a very important subject that most people think of but some do little about. I’m glad you covered this because I’m working on something that this would be very helpful for.

Rebecca Smith

Life insurance is a must if you have children, I believe. Both myself and my partner have policies in place. Thank you for talking about such an important topic.

Valerie Claresta

I already registered life insurance since in college. My brother did to me. Now I got the benefits of it after 10 years and open small business used this money.

Yudith

Everyone should have insurance. We don’t know what happen in the future. All my family members has insurance.

Emman Damian

We need insurance at this challenging time. I should really check them out. I hope they can give me competitive rates. I have another one from a competitor company.